Introduction of Digital Tax at 6% - Will it affect the Services Account of BOP?

- BOPstatsMY

- Mar 11, 2020

- 2 min read

The rise of technology development has given a huge impact on the economy especially in facilitating the international cross border goods and services thus, enabling the human daily lives become easier and borderless. According to the International Monetary Fund (IMF), digital trade defined as all cross-border transactions that are either digitally ordered (i.e. cross-border e-commerce), digitally facilitated (by platforms), or digitally delivered.

Sales and Service Tax (SST) was introduced in Malaysia since 1st September 2018 which covers services sector such as advertising services, clubs, courier services, digital services, domestic flight, food & beverages, hire passenger vehicles services, information technology services, motor vehicle services or repair centre, paid television broadcasting services, parking services, professional services and telecommunication services. Starting 1st January 2020, digital tax was implemented at the rate of 6% by the Malaysian government. Consumers in Malaysia who use foreign digital services might face a price increase. On the other side, the objective of the tax is to spark competition among local and foreign providers in related sectors in this country.

The implementation of service tax on digital service has been amended in July 2019 by the government to make the foreign service providers be liable to be registered with the Royal Malaysian Customs Department if they expect to exceed RM500,000 for annual threshold of digital services.

This tax imposed on many tech-based companies which provide digital services such as software, application, video games, music, database and hosting, and digital advertising. This means Google, Facebook, Netflix and many other are included.

In terms of global digital services tax developments, Malaysia has become the second country in Southeast-Asia after Singapore to implement such tax. Singapore has imposed at 7%. Other countries which also imposed this tax are Japan (8%), South Korea (10%) and Bangladesh (15%).

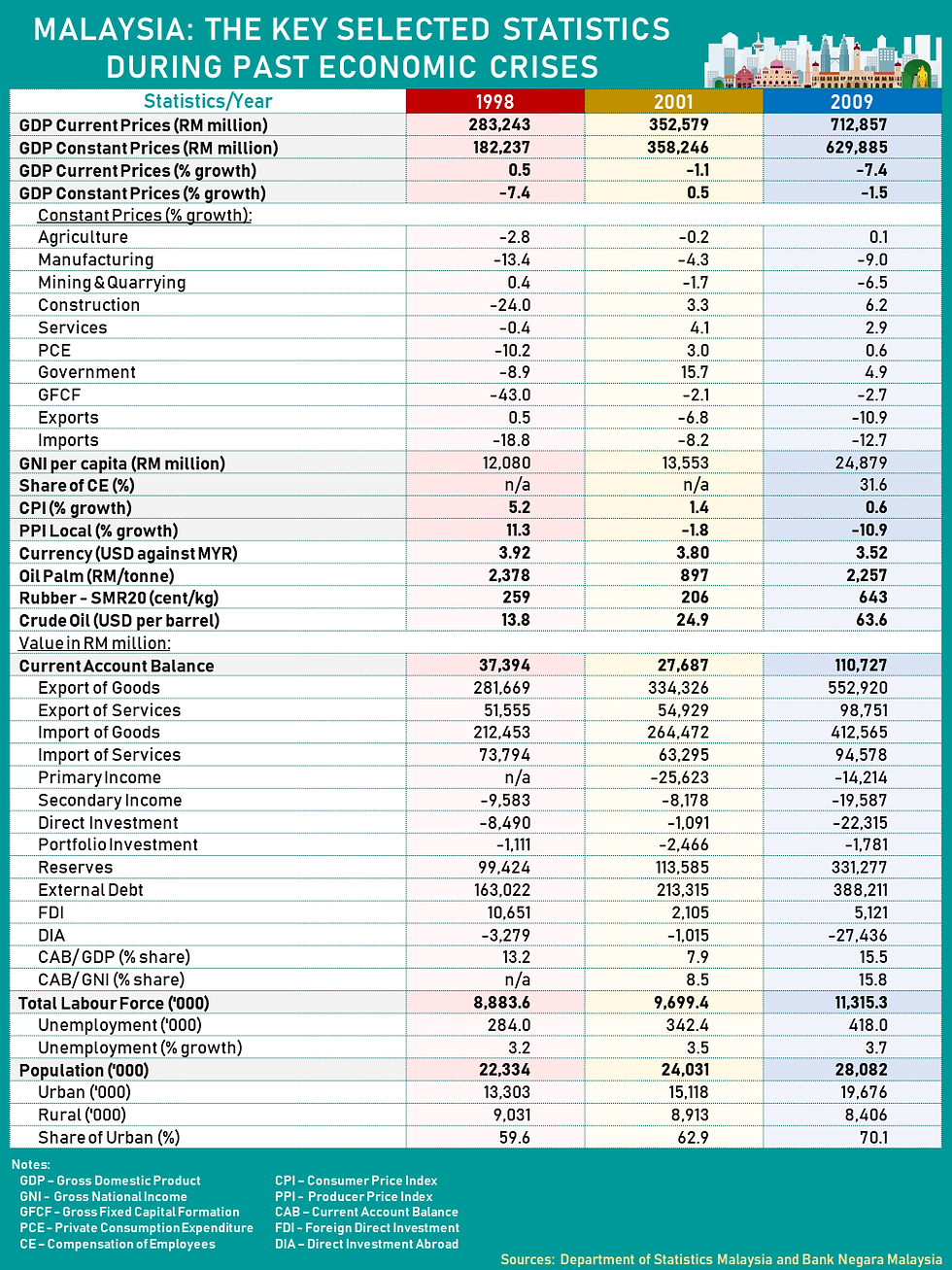

Under the Services Account of Balance of Payments (BOP), components which will be imposed the 6% digital tax are professional of Other Business Services (OBS) and Telecommunication, Computer and Information (TCI). In 2019, the imports share of OBS and TCI to total imports of Services Account accounted for 11% and 8% respectively.

How is this tax will be reflected on the Balance of Payments? Will it impact the imports of OBS and TCI components in Service Account? Stay tuned with us for the latest update of BOP when we release the Annual and Quarter 1, 2020 BOP Statistics on 13 May 2020 (Wednesday).

Prepared by: Pameza Abdul Harip, BOP Division, DOSM

Comments