IMF Blog Updates: COVID-19 Crisis Poses Threat to Financial Stability

- BOPstatsMY

- Apr 15, 2020

- 1 min read

"The COVID-19 pandemic has caused an unprecedented human and health crisis. The measures necessary to contain the virus have triggered an economic downturn. At this point, there is great uncertainty about its severity and length.The latest Global Financial Stability Report shows that the financial system has already felt a dramatic impact, and a further intensification of the crisis could affect global financial stability."

"Volatility has spiked, in some cases to levels last seen during the global financial crisis, amid the uncertainty about the economic impact of the pandemic. With the spike in volatility, market liquidity has deteriorated significantly, including in markets traditionally seen as deep, like the U.S. Treasury market, contributing to abrupt asset price moves."

"Central banks have reactivated programs used during the global financial crisis as well as launched a range of new broad-based programs, including to purchase riskier assets such as corporate bonds. By effectively stepping in as “buyers of last resort” in these markets and helping contain upward pressures on the cost of credit, central banks are ensuring that households and firms continue to have access to credit at an affordable price."

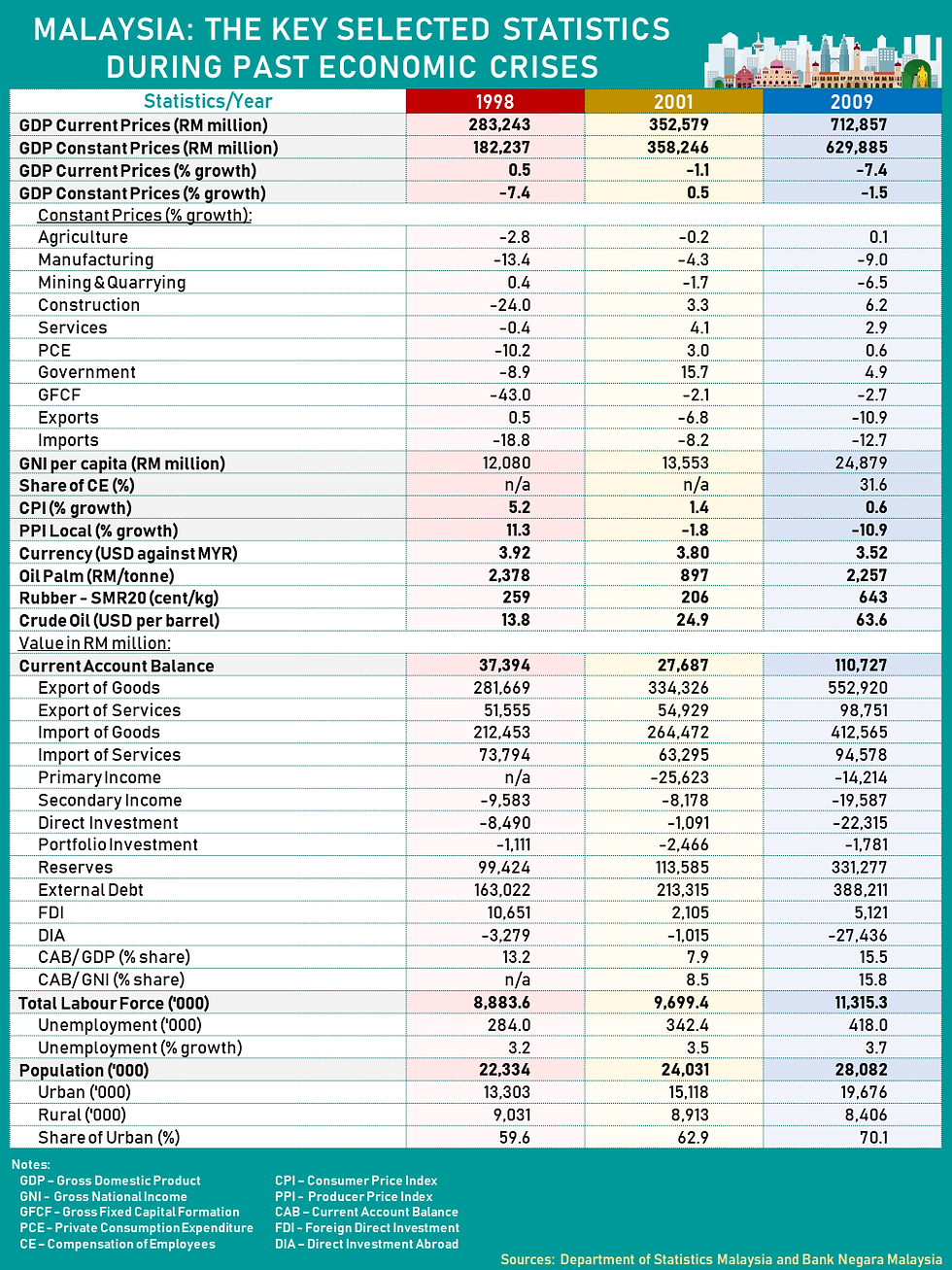

Volatility in markets will eventually affect the statistics of Financial Account in BOP especially in Portfolio Investment.

Check out the full article of IMF blog reviewing on the global financial stability here

Comments